Celebrate Spring at these 6 Festivals in Texas

Everything’s bigger in Texas — including our spring festival season. And this year is certainly no exception.

The days are getting warmer, and the nights are getting longer, so we know everyone’s itching to get back outside and experience all the music, food, and art our great state has to offer. With countless festivals to choose from, we’ve narrowed down the best-of-the-best events, so you can start planning your spring bucket list now.

From big-name country headliners to award-winning food vendors, there’s no shortage of opportunities for the whole family to get out and about and enjoy all that springtime in Texas has to offer!

MAIN ST. Fort Worth Arts Festival (April 18-21)

We’d be remiss if we didn’t kick off our list with Texas’ largest arts festival — and the largest four-day event in the Southwest — located in the heart of Fort Worth’s Sundance Square!

As you stroll the square, you’ll find featured artists from across the globe, from painters and sculptors to artisan crafters. And even if you’re not an art connoisseur, you can still enjoy some of Sundance Square’s staple restaurants, like Reata Restaurant, or check out otherlocal food trucks along the promenade.

No event makes downtown Fort Worth shine quite like the MAIN ST. Arts Festival. This is one of North Texas’ biggest events of the year, so be sure to mark your calendars and start planning your trip to Cowtown today!

Austin Blues Festival (April 27-28)

In the heart of downtown Austin, the Moody Amphitheater will come alive this spring with the timeless melodies of blues legends and rising stars at the second annual Austin Blues Festival.

Featuring Buddy Guy and Grammy Award-winner Brittany Howard (Alabama Shakes), there’ll be no shortage of big-name and local talent. And, as Austin is notorious for its mouth-watering food scene, myriad food vendors will be in attendance so you can sample the best of Austin’s local restaurants all in one place.

When you’re there, be sure to stop by Big Henry’s Vinyl & Gifts’ vintage records pop-up booth, where you can browse a curated selection of classics, rare finds, and limited editions, each holding a piece of music history to commemorate your weekend in our capital city.

Ennis Bluebonnet Trails Festival (April 19-21)

Located about 35 minutes south of downtown Dallas, the little town of Ennis is known as one of the best places to observe beautiful spring bluebonnets in the state. In fact, the 1997 State Legislature designated Ennis the Official Bluebonnet City of Texas. Every spring, the state flower of Texas blankets fields and lines highways, bringing a stunning splash of royal blue to the landscape.

While visitors can drive through more than 40 miles of mapped bluebonnet trails throughout the month of April at the Ennis Bluebonnet Trails, the actual festival in downtown Ennis will offer family-friendly carnival rides, shopping vendors, food and drink, fun activities like a petting zoo and face painting, and live music in addition to the trails.

Access to the bluebonnet trails is always free, and festival admission for adults is $5 per day. Children 12 and under enjoy free admission.

Sweet Beats Music Fest (May 4-5)

Start planning your weekend getaway to Sugar Land because you won’t want to miss out on Sweet Beats Music Fest.

Billed as a “two-day extravaganza,” the Sweet Beats festival promises fun for the whole family — and live music is just the start! Live reptile and BMX shows, face painting, and a plethora of local food vendors will keep you busy all weekend long.

Oh! Did we mention Sweet Beats is offering Sugar Land’s largest Cinco de Mayo celebration? You can stop at the cantina to stay hydrated as you peruse the local vendor booths surrounding the festival.

Big As Texas (May 10-12)

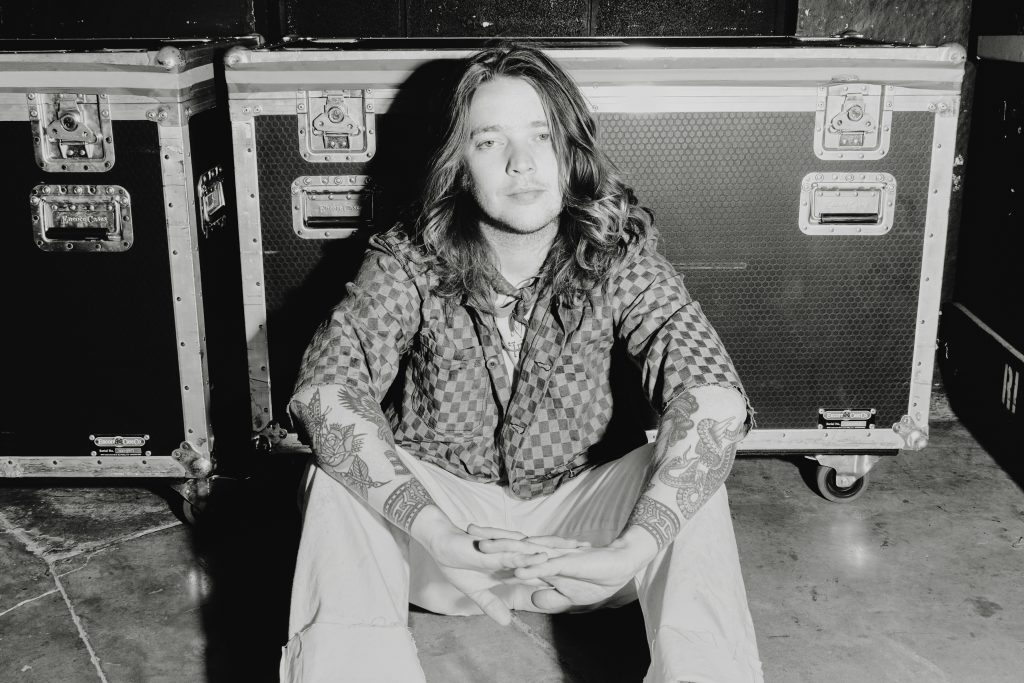

We are in Texas, after all, so country music is bound to be a running theme in this list. But the Big As Texas festival won’t just be offering killer local artists. The independently produced country and Americana music festival is bringing in Grammy Award nominees Thomas Rhett and Dierks Bentley to headline the three-day festival at the Montgomery County Fairgrounds, located just outside of Houston.

In addition to the world-class music lineup, the festival will feature dozens of Texas food vendors and artisans to keep you fueled through the weekend, plus custom exhibitions, immersive art installations, live-fire grilling, carnival games, and more for attendees of all ages.

As if you needed any more convincing to get your Big As Texas tickets now, the festival is also collecting a portion of net ticket proceeds to donate toward suicide prevention. Big As Texas is your family’s opportunity to have fun and do some good this spring — does it get any better than that?

Fredericksburg Crawfish Festival (May 24-26)

If you’re ragin’ for some Cajun this Memorial Day weekend, then the Fredericksburg Crawfish Festival is a must.

This festival is one of the largest events of the year in Fredericksburg — and you’ll get more than just your yearly fill of crawfish when you go. Held in the Marktplatz, the Fredericksburg Crawfish Festival features live music and arts and crafts vendors, ensuring there’s something everyone in your family can enjoy.

If crawfish isn’t exactly “your thing,” don’t worry! While crawfish is the star of the festival, there will be plenty of other local food vendors to keep every stomach in attendance happy, too.

Your Festival Packing List

Don’t rush out to one of these festivals empty-handed! It’s always a good idea to pack a day bag with some necessities, especially if you’ll have little ones in tow. We recommend having at least these items on hand before you head out for your day of festival fun.

- An empty water bottle to fill upon arrival

- Portable phone chargers and charging bank

- SPF and lip balm

- Sun hats

- Bug spray

- Portable fan

- Cleansing wipes and/or hand sanitizer

- Simple first-aid supplies (e.g., ibuprofen, bandages, etc.)

Fun for the Whole Family

Whether you consider yourself a foodie, a local music die-hard, or simply someone who wants to see what Texas in the spring has to offer, there’s sure to be a festival on this list for you!

Live a few hours away from the festival? Embrace the journey, double the fun, and make a road trip out of it!

© 2024 Texas Farm Bureau Insurance